National Bureau of Statistics of China

February 28, 2021

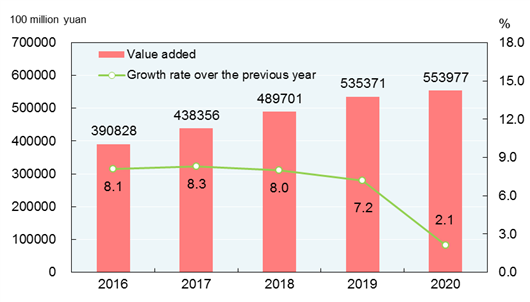

IV. Service Sector

In 2020, the value added of the wholesale and retail trades was 9,568.6 billion yuan, down by 1.3 percent over the previous year; that of transport, storage and post was 4,156.2 billion yuan, up by 0.5 percent; that of hotels and catering services was 1,597.1 billion yuan, down by 13.1 percent; that of financial intermediation was 8,407.0 billion yuan, up by 7.0 percent; that of real estate was 7,455.3 billion yuan, up by 2.9 percent; that of information transmission, software and information technology services was 3,795.1 billion yuan, up by 16.9 percent; and that of leasing and business services was 3,161.6 billion yuan, down by 5.3 percent. In 2020, the business revenue of service enterprises above the designated size grew by 1.9 percent over the previous year, and the operating profits decreased by 7.0 percent.

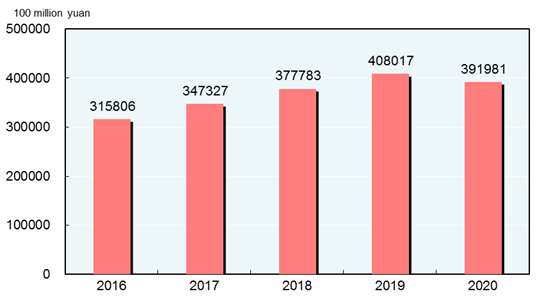

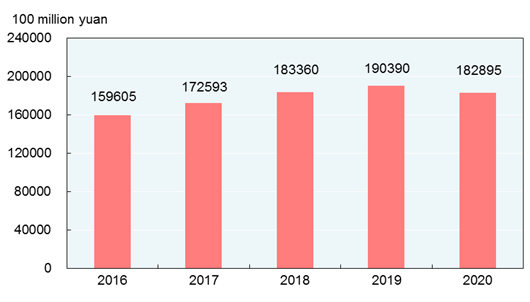

Figure 9: Value Added and Growth Rates of Service Sector 2016-2020

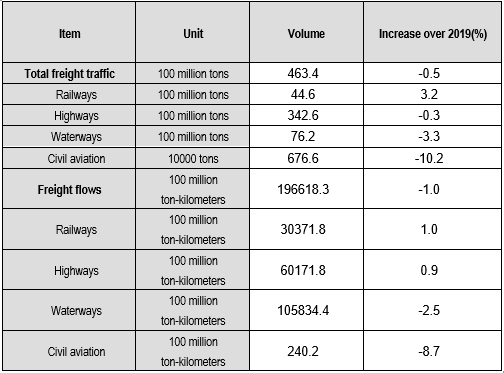

The total freight traffic[1] in 2020 reached 46.3 billion tons. The freight flows were 19,661.8 billion ton-kilometers. The volume of freight handled by ports throughout the year totaled 14.5 billion tons, up by 4.3 percent over the previous year, of which the freight for foreign trade was 4.5 billion tons, up by 4.0 percent. Container shipping of ports reached 264.30 million standard containers, up by 1.2 percent.

Table 3: Freight Traffic by All Means of Transportation and Growth Rates in 2020

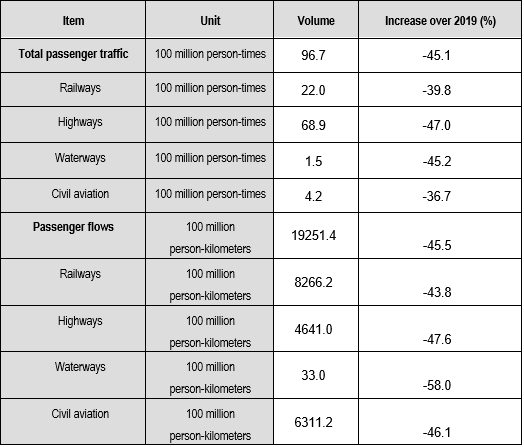

In 2020, the total passenger traffic was 9.7 billion person-times, down by 45.1 percent over 2019, and the passenger flows were 1,925.1 billion person-kilometers, down by 45.5 percent.

Table 4: Passenger Traffic by All Means of Transportation and Growth Rates in 2020

The total number of motor vehicles for civilian use reached 280.87 million (including 7.48 million tri-wheel motor vehicles and low-speed trucks) by the end of 2020, up by 19.37 million over that at the end of 2019, of which the privately-owned vehicles numbered 243.93 million, an increase of 17.58 million. The total number of cars for civilian use was 156.40 million, an increase of 9.96 million, of which the privately-owned cars numbered 146.74 million, an increase of 9.73 million.

The turnover of post services[2] totaled 2,105.3 billion yuan, up by 29.7 percent over the previous year. In 2020, the number of mail delivery was 1.42 billion; that of parcel delivery was 20 million; and that of express delivery was 83.36 billion with a revenue reaching 879.5 billion yuan. The turnover of telecommunication services[3] totaled 13,675.8 billion yuan, up by 28.1 percent over the previous year. By the end of 2020, there were 1,775.98 million phone subscribers in China, of whom 1,594.07 million were mobile phone subscribers. Mobile phone coverage was 113.9 sets per 100 persons. The number of fixed broadband internet users[4] reached 483.55 million, an increase of 34.27 million over the end of the previous year. Of this total, fixed fiber-optic broadband internet users[5] amounted to 454.14 million, an increase of 36.75 million. The mobile internet traffic in 2020 was 165.6 billion gigabytes, up by 35.7 percent over the previous year. The number of internet user was 989 million at the end of 2020, 986 million of which were mobile internet surfers[6]. The coverage of internet was 70.4 percent, and 55.9 percent in rural areas. Software revenue from software and information technology services industry[7] in 2020 was 8,161.6 billion yuan, up by 13.3 percent over 2019 on a comparable basis.

Figure 10: Express Delivery and Growth Rates 2016-2020

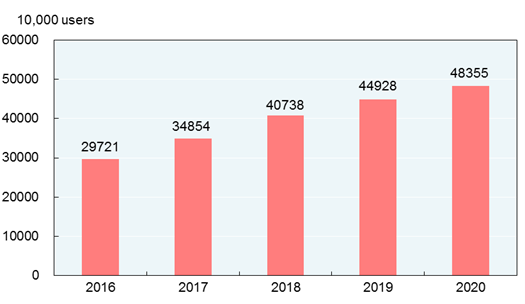

Figure 11: Year-end Number of Fixed Broadband Internet Users 2016-2020

V. Domestic Trade

In 2020, the total retail sales of consumer goods reached 39,198.1 billion yuan, a decrease of 3.9 percent over the previous year. An analysis on different areas showed that the retail sales of consumer goods in urban areas stood at 33,911.9 billion yuan, down by 4.0 percent, and that in rural areas reached 5,286.2 billion yuan, down by 3.2 percent. Grouped by consumption patterns, the retail sales of commodities was 35,245.3 billion yuan, down by 2.3 percent, and that of catering industry was 3,952.7 billion yuan, down by 16.6 percent.

Figure 12: Total Retail Sales of Consumer Goods 2016-2020[8]

Of the total retail sales of commodities by enterprises above the designated size, the year-on-year growth of retail sales for grain, oil and food went up by 9.9 percent; beverage up by 14.0 percent; tobacco and liquor up by 5.4 percent; clothes, shoes, hats and textiles down by 6.6 percent; cosmetics up by 9.5 percent; gold, silver and jewelry down by 4.7 percent; daily necessities up by 7.5 percent; household appliances and audio-video equipment down by 3.8 percent; traditional Chinese and western medicines up by 7.8 percent; cultural and office appliances up by 5.8 percent; furniture down by 7.0 percent; telecommunication equipment up by 12.9 percent; building and decoration materials down by 2.8 percent; petroleum and petroleum products down by 14.5 percent; and motor vehicles down by 1.8 percent.

In 2020, the online retail sales of physical goods were 9,759.0 billion yuan, up by 14.8 percent over the previous year on a comparable basis, accounting for 24.9 percent of the total retail sales of consumer goods, or 4.0 percentage points higher than that of 2019.

VI. Investment in Fixed Assets

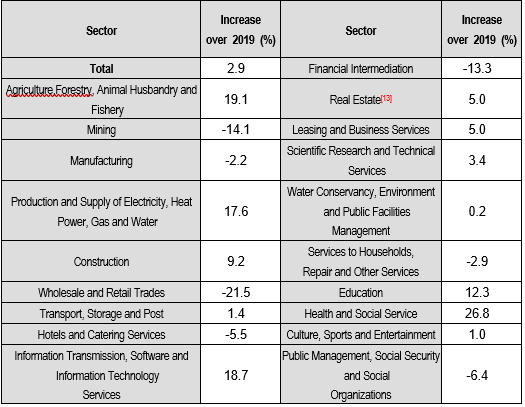

The total investment in fixed assets[9] of the country in 2020 was 52,727.0 billion yuan, up by 2.7 percent over the previous year. Of the total, the investment in fixed assets (excluding rural households) was 51,890.7 billion yuan, up by 2.9 percent. By regions[10], the investment in eastern areas was up by 3.8 percent over the previous year, central areas up by 0.7 percent, western areas up by 4.4 percent, and northeastern areas up by 4.3 percent.

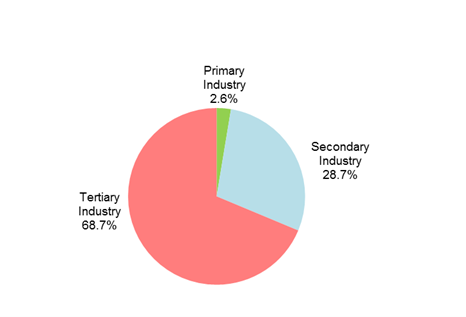

In the investment in fixed assets (excluding rural households), the investment in the primary industry was 1,330.2 billion yuan, up by 19.5 percent over the previous year; that in the secondary industry was 14,915.4 billion yuan, up by 0.1 percent; and that in the tertiary industry was 35,645.1 billion yuan, up by 3.6 percent. The private investment in fixed assets[11] was 28,926.4 billion yuan, up by 1.0 percent. The investment in infrastructure[12] saw an increase of 0.9 percent.

Figure 13: Shares of Investment in Fixed Assets of the Three Industries (Excluding Rural Households) in 2020

Table 5: Growth Rates of Investment in Fixed Assets (Excluding Rural Households) by Sectors in 2020

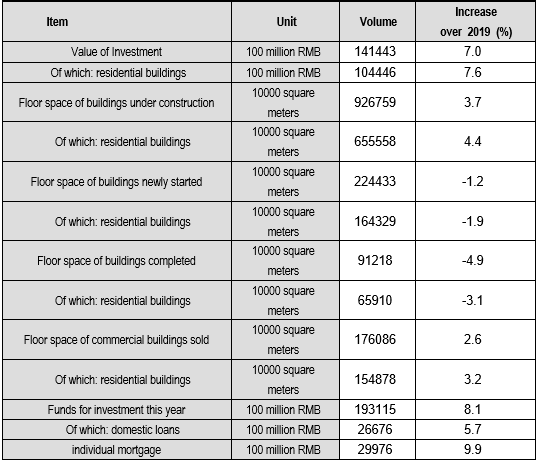

In 2020, the investment in real estate development was 14,144.3 billion yuan, up by 7.0 percent over the previous year. Of this total, the investment in residential buildings reached 10,444.6 billion yuan, an increase of 7.6 percent, that in office buildings was 649.4 billion yuan, up by 5.4 percent, and that in buildings for commercial business was 1,307.6 billion yuan, down by 1.1 percent. The floor space of the commercial buildings for sale was 498.50 million square meters at the end of 2020, an increase of 0.29 million square meters over that at the end of 2019. The floor space of the commercial residential buildings for sale was 223.79 million square meters, a decrease of 0.94 million square meters.

In 2020, 2.09 million housing units were started to be rebuilt in rundown urban areas nationwide. The number of housing units rebuilt in rundown areas was 2.03 million. In rural areas of China, for the poverty-stricken households that had their economic status registered at the local governments, 742.1 thousand[14] of them witnessed their dilapidated houses rebuilt or renovated in 2020 as the round-off of the programme in the fight against poverty.

Table 7: Main Indicators for Real Estate Development and Sales and Growth Rates in 2020

VII. Foreign Economic Relations

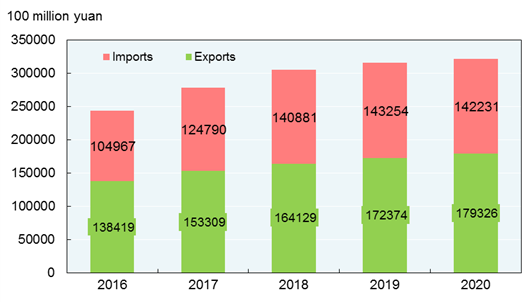

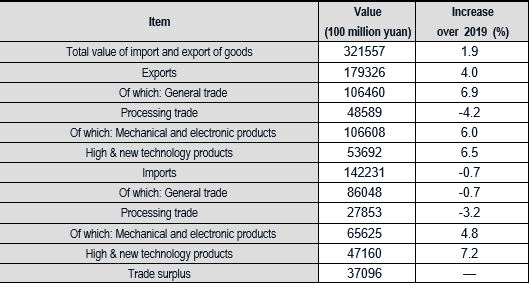

The total value of imports and exports of goods in 2020 reached 32,155.7 billion yuan, up by 1.9 percent over that of the previous year. Of this total, the value of goods exported was 17,932.6 billion yuan, up by 4.0 percent; the value of goods imported was 14,223.1 billion yuan, down by 0.7 percent. The surplus of trade in goods reached 3,709.6 billion yuan, up by 797.6 billion yuan over that of the previous year. The total value of imports and exports between China and countries along the Belt and Road[15] was 9,369.6 billion yuan, an increase of 1.0 percent over that of the previous year. Of the total, the value of goods exported was 5,426.3 billion yuan, an increase of 3.2 percent; that of goods imported was 3,943.3 billion yuan, a decrease of 1.8 percent.

Figure 14: Imports and Exports of Goods 2016-2020

Table 8: Total Value and Growth Rates of Import and Export of Goods in 2020

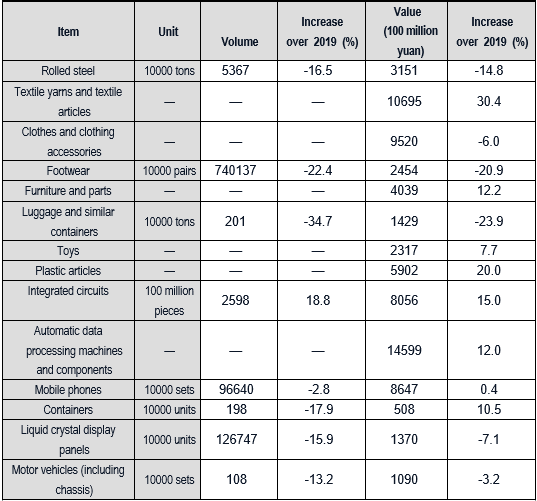

Table 9: Main Export Commodities in Volume and Value and the Growth Rates in 2020

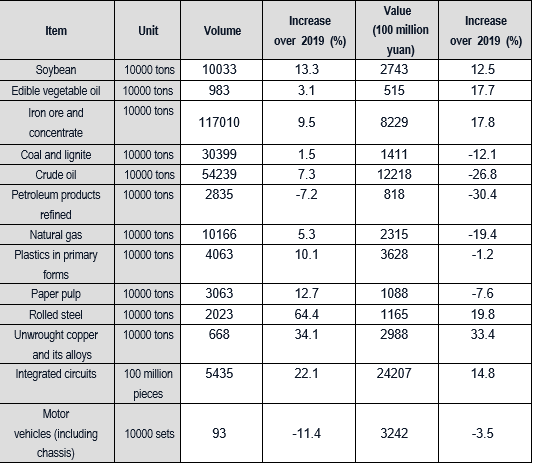

Table 10: Main Import Commodities in Volume and Value and the Growth Rates in 2020

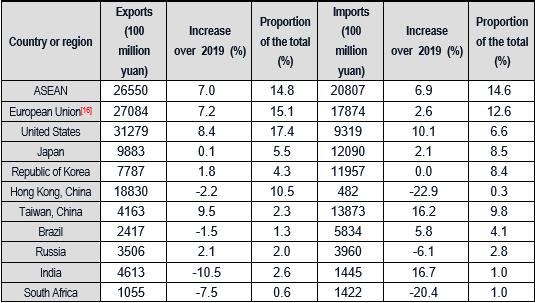

Table 11: Imports and Exports of Goods by Major Countries and Regions, the Growth Rates and Proportions in 2020

The total value of imports and exports of services in 2020 was 4,564.3 billion yuan, down by 15.7 percent over that of the previous year. The export value of services was 1,935.7 billion yuan, down by 1.1 percent. The import value of services was 2,628.6 billion yuan, down by 24.0 percent. The trade deficit in imports and exports of services was 692.9 billion yuan.

The year 2020 witnessed the establishment of 38,570 enterprises (excluding banking, securities and insurance) with foreign direct investment, down by 5.7 percent over that of the previous year, and the foreign direct investment actually utilized totaled 1,000.0 billion yuan, up by 6.2 percent, or 144.4 billion US dollars, up by 4.5 percent. Specifically, there were 4,294 newly established enterprises receiving direct investment from countries along the Belt and Road (including the investment in China via some free ports), down by 23.2 percent; and foreign capital directly invested in China reached 57.4 billion yuan, down by 0.3 percent, or 8.3 billion US dollars, down by 1.8 percent. In 2020, the foreign investment actually utilized by high technology industry reached 296.3 billion yuan, up by 11.4 percent, or 42.8 billion US dollars, up by 9.5 percent.

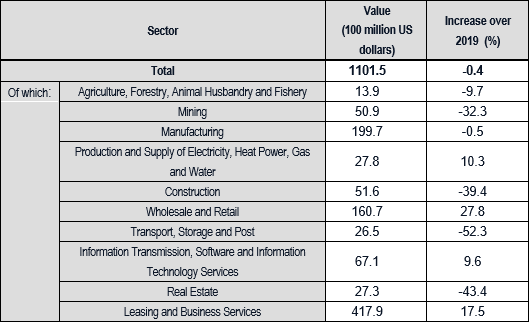

Table 12: Total Value of Foreign Direct Investment (Excluding Banking,

Securities and Insurance) and the Growth Rates in 2020

In 2020, the non-financial outbound direct investment reached 759.8 billion yuan, down by 0.4 percent over that of the previous year, or 110.2 billion US dollars, down by 0.4 percent. Of this total, that to countries along the Belt and Road reached 17.8 billion US dollars, up by 18.3 percent.

Table 13: Total Value and Growth Rates of Non-financial Outbound Direct Investment in 2020

In 2020, the accomplished business revenue through contracted overseas engineering projects was 1,075.6 billion yuan, down by 9.8 percent over that of the previous year, or 155.9 billion US dollars, down by 9.8 percent. Specifically, the accomplished business revenue from countries along the Belt and Road was 91.1 billion US dollars, a decrease of 7.0 percent, accounting for 58.4 percent of the accomplished business revenue through contracted overseas engineering projects. The number of labor forces sent abroad through overseas labor contracts was 300 thousand.

VIII. Finance and Financial Intermediation

The national general public budget revenue reached 18,289.5 billion yuan in 2020, down by 3.9 percent over that of the previous year, of which tax revenue amounted to 15,431.0 billion yuan, down by 2.3 percent. The national general public budget expenditure reached 24,558.8 billion yuan, up by 2.8 percent over that of the previous year. The year 2020 witnessed a further tax and fee cuts of over 2.5 trillion yuan.

Figure 15: General Public Budget Revenue 2016-2020

Note: Data for general public budget revenue from 2016 to 2019 as shown in the figure were final accounts and that of 2020 was the executive accounts.

By the end of 2020, money supply of broad sense (M2) was 218.7 trillion yuan, an increase of 10.1 percent over that by the end of the previous year. Money supply of narrow sense (M1) was 62.6 trillion yuan, up by 8.6 percent. Cash in circulation (M0) was 8.4 trillion yuan, up by 9.2 percent.

In 2020, the aggregate financing to the real economy (AFRE) (flow)[17] reached 34.9 trillion yuan, or 9.2 trillion yuan more than that in 2019 on a comparable basis. The AFRE (stock)[18] totaled 284.8 trillion yuan at the end of 2020, up by 13.3 percent over that at the end of 2019 on a comparable basis. Specifically, loans granted to the real economy in Renminbi stood at 171.6 trillion yuan, up by 13.2 percent. Savings deposit in Renminbi and foreign currencies in all items of financial institutions totaled 218.4 trillion yuan at the end of 2020, an increase of 20.2 trillion yuan compared with that at the beginning of the year. Of this total, the savings deposit in Renminbi stood at 212.6 trillion yuan, an increase of 19.6 trillion yuan. Loans in Renminbi and foreign currencies in all items of financial institutions reached 178.4 trillion yuan, an increase of 19.8 trillion yuan. Of this total, loans in Renminbi were 172.7 trillion yuan, an increase of 19.6 trillion yuan. Inclusive finance loans in Renminbi[19] reached 21.5 trillion yuan, an increase of 4.2 trillion yuan.

Table 14: Savings Deposit and Loans in RMB and Foreign Currencies in All Financial Institutions and Growth Rates at the End of 2020

Loans in Renminbi from rural financial institutions (rural credit cooperatives, rural cooperation banks and rural commercial banks) totaled 21,588.6 billion yuan by the end of 2020, an increase of 2,521.0 billion yuan as compared with that at the beginning of the year. Loans in Renminbi for consumption use from all financial institutions totaled 49,566.8 billion yuan, an increase of 5,599.4 billion yuan. Of the total, short-term personal loans totaled 8,777.4 billion yuan, an increase of 717.7 billion yuan, and medium- and long-term personal loans reached 40,789.4 billion yuan, an increase of 4,881.7 billion yuan.

Funds raised through A-shares issued on Shanghai and Shenzhen Stock Exchanges[20] amounted to 1,541.7 billion yuan in 2020, an increase of 188.3 billion yuan from the previous year. 394 A-shares were newly issued, raising 474.2 billion yuan worth of capital altogether, up by 225.2 billion yuan over that of the previous year. Of the total, 145 shares were from the science and technology innovation board, raising 222.6 billion yuan; refinancing of A-shares (including public newly issued, targeted placement, right issued, preferred stock and exchanged convertible bonds) raised 1,067.4 billion yuan, a decrease of 37.0 billion yuan over that of the previous year. Various types of market entities financed 8,477.7 billion yuan through issuing bonds (including corporate bonds, convertible bonds, exchangeable bonds, financial bonds issued by policy banks, local government bonds and asset-backed securities) on Shanghai and Shenzhen Stock Exchanges, up by 1,279.1 billion yuan over that of the previous year. There were 8,187 companies listed on National Equities Exchange and Quotations[21] and funds raised by listed companies reached 33.9 billion yuan in 2020.

In 2020, 14.2 trillion yuan corporate debenture bonds[22] were issued, an increase of 3.5 trillion yuan over that of the previous year.

The premium of primary insurance received by the insurance companies[23] totaled 4,525.7 billion yuan in 2020, up by 6.1 percent over that of the previous year. Of this total, life insurance premium of primary insurance amounted to 2,398.2 billion yuan, health and casualty insurance premium of primary insurance 934.7 billion yuan, and property insurance premium of primary insurance 1,192.9 billion yuan. Insurance companies paid an indemnity worth of 1,390.7 billion yuan, of which, life insurance indemnity was 371.5 billion yuan, health and casualty insurance indemnity 323.7 billion yuan, and property insurance indemnity 695.5 billion yuan.

Notes:

1. The total freight traffic and flows include the traffic and flows by railways, highways, waterways and civil aviation and the growth rates in 2020 are calculated on a comparable basis. Due to the change of data source of certain pipeline transportation of petroleum and gas caused by the foundation of PipeChina, data of pipeline transportation are being verified.

2. The turnover of post services is calculated at constant prices of 2010.

3. The turnover of telecommunication services is calculated at constant prices of 2015.

4. Fixed broadband internet users refer to those who subscribed to the telecommunication enterprises and access the Internet through xDSL, FTTx+LAN, FTTH/0 and other broadband access ways as well as general dedicated lines at the end of the reporting period.

5. Fixed fiber-optic broadband internet users refer to those who subscribed to the telecommunication enterprises and access the Internet through FTTH or FTT0 at the end of the reporting period.

6. The number of mobile internet surfers refers the number of people who have accessed the internet through mobile phones.

7. Software and information technology services industry includes software development, integrated circuit design, information system integration and internet of things technology services, operation maintenance services, information processing and storage support services, IT consulting services, digital content services and other IT services industry.

8. The total retail sales of consumer goods from 2016 to 2019 have been revised based on the fourth National Economic Census and the related programmes.

9. The figure of the investment in fixed assets in 2019 was revised according to the results of the fourth national economic census, statistical law enforcement and the statistical survey method reform and programmes. The growth rates in 2020 are calculated on a comparable basis.

10. See Note 17.

11. Private investment in fixed assets refers to investment in the construction or purchase of fixed assets by domestic collective, private and individual-owned enterprises and organizations or their holding enterprises (with absolute holding and relative holding enterprises).

12. Investment in infrastructure includes transportation, postal service, telecommunication, radio, TV and satellite transmission, internet and related services, water conservancy, environment and public facilities management.

13. The investment in real estate includes the investment in real estate development, construction of buildings for own use, property management, intermediary services and other real estate investment.

14. The number of housing units of the poverty-stricken rural households with their economic status registered at the local governments that were started to be rebuilt or renovated includes the 641.6 thousand units in stock from 2019 and another 100.5 thousand unit found in the re-examination of the poverty reduction.

15. The Belt and Road refers to the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

16. The value of imports and exports of goods by European Union excludes data of the Great Britain, and the growth rate is calculated on a comparable basis.

17. The AFRE (flow) refers to the total volume of financing provided by the financial system to the real economy within a certain period of time.

18. The AFRE (stock) refers to the outstanding financing provided by the financial system to the real economy (domestic non-financial enterprises and persons) at the end of a period of time (a month, a quarter or a year).

19. Inclusive finance loans include loans to micro and small businesses with single-client credit line under 10 million yuan, operating loans to self-employed businesses and owners of micro and small businesses, producing and operating loans to farmers, consumption loans to registered people living in poverty, venture guarantee loans and student loans.

20. Funds raised through Shanghai and Shenzhen Stock Exchanges are calculated by the money raised on the listing date, and the funds raised include the actual exchanged convertible bonds, which were 99.5 billion yuan in 2019 and 119.5 billion yuan in 2020.

21. National Equities Exchange and Quotations, also called “the New Over-the-Counter Market”, is a national securities exchange established upon approval by the State Council in 2012. Preferred stocks were excluded from funds raised by listed companies in National Equities Exchange and Quotations. Funds raised by shares are calculated by the disclosure date of the insurance report.

22. Corporate debenture bonds include debt financing instruments of non-financial businesses, enterprise bonds, corporate bonds and convertible bonds.

23. The premium of primary insurance received by the insurance companies refers to the premium income from primary insurance contracts confirmed by the insurance companies.

Source: <http://www.stats.gov.cn/english/PressRelease/202102/t20210228_1814177.html>

Edited by Bao Lianying